What Is a Promissory Note and How Does It Work?

What is a Promissory Note? A complete Detail on Promissory Note Uses, Template, Examples, Advantages, And Disadvantages.

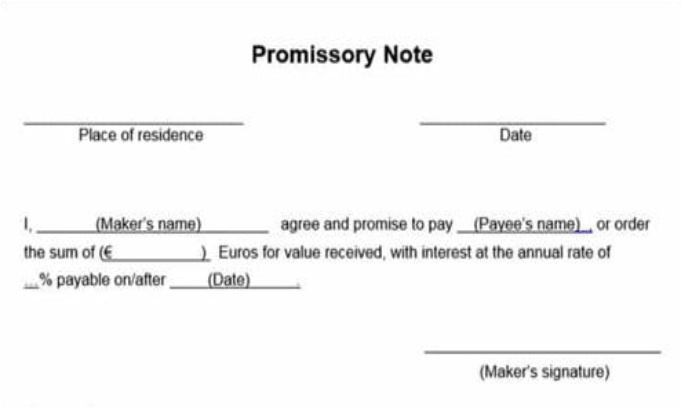

A promissory note is a contractual document that comprises a written commitment by one party to pay another party a certain amount of money, immediately or at a specific date. A PN usually includes all the terms of the loan, including the principal sum, interest rate, expiration; and location of payment, and the lender’s signatures.

They enable businesses and individuals to obtain funding from sources other than banks. This source may be a person or a company willing to bring the note (and provide the funding) on the terms agreed. Promissory notes, in general, allow everyone to be a lender. For example, you might be made to issue a promissory note to get a small personal loan.

Writing the Terms of the Promissory Note

You will not have to start from scratch when writing a promissory note. You may make or download an example of a promissory note using a template available at CocoSign. CocoSign is a reputed brand in 190+ countries worldwide.

Many individuals and organizations use it to streamline their workflow. It offers a 14 days free trial as well. All a user needs is to signup for a free account and agree to the terms and conditions. Before you get started, you’ll have to collect some details and decide about the loan’s structure.

First, you’ll need to have the lender’s and borrower’s contact details. The following are the basic terms of service of a promissory note:

- The total sum of money lent.

- If you’re charging interest, add the interest rate to the agreement. The interest rate should not be more than the maximum allowed by your state’s laws.

- Use collateral or “safety” for making a secured PN.

- You’ll also have payment terms for the PN, like:

- The total sum of all payments. You may require payments to be paid regularly, such as weekly. Alternatively, a lump sum payment may be made.

- When are the payments due?

- Payouts should be submitted to which address.

- Late payment penalties.

From Where to get Promissory Note Template for Free

CocoSign offers you the facility to download a free promissory note template & customize it according to your need. So visit CocoSign to get a promissory note template.

If you just want the debtor to promise to give up property (like jewelry, vehicles, companies, or stocks) if they don’t repay, use a protected promissory note.

Unprotected Obligatory Note is useful when you don’t want the creditor to promise to give up the property if they don’t repay. In exchange, lenders often ask for higher interest.

What are the advantages and disadvantages of PN?

When a person cannot obtain a loan from a conventional lender, like a bank, a promissory note may be beneficial. On the other hand, promissory notes are extremely risky as its lender lacks the monetary institution’s resources and size of capital.

In the case of a claim, legal problems may arise for both the issuer and the recipient. As a result, having a PN signed before signing any contracts is very important.

A promissory note further explains what constitutes a “default,” as well as the lender’s legal recourse in the event of a default. Nonpayment for a certain period, for instance, could be considered a default; as well as the lender could be permitted to confiscate the collateral.

When Can a Promissory Note Be Uses?

If you’re borrowing or lending money, you can draft a PN; that includes payment terms, rate of interest, leverage, and penalties for late payments. Promissory notes come in a variety of shapes and sizes; they can be used for a variety of purposes, and you can Use collateral including:

- Loans between relatives, friends, and coworkers.

- Loans for students

- Mortgages, housing loans, and land down payments

- Loans for automobiles, vehicles, or automobiles

- Bank loan, a consumer loan, a company loan, or an equity loan.

In general, a promissory note must be use for simpler loans with simple payment terms, and a legal agreement should be used for more complicated loans.

A PN. should be signed by the creditor & to verify that the signature is genuine; you may ask the borrower to sign in front of a registrar or using CocoSign.

The lender holds the initial promissory note, and the debtor should receive a copy. Keep the PN with the personal documents so you can quickly locate them when necessary.

Wrapping Up

When both parties have completed all of the obligations specified in the initial contract, a PN release is necessary. Each participant should decide whether they are satisfied with the way the loan terms were fulfilled.

If some collateral was being used to secure the loan; the release must state that the lease or other lock on it has been lifted.

A reference to the actual promissory note as well as its date; and the original loan balance, should be included in the release. The release must state that the terms of the agreement have been met; and that the creditor is no longer liable.